2025 European Digital News Pricing Report

We’ve mapped pricing, discounting, and trial strategies from 101 European newsrooms. If you're planning to launch or rethink your digital subscription model this year, this is for you.

"In [our country], no one will pay [X] much for a digital news subscription."

If I had X euros for every time I've heard this argument... Newsrooms entering the audience revenue space are often trying to compete on price which is totally understandable. With limited disposable incomes, saturated markets with heavy competition, and Netflix offering nigh infinite content for ~7 euros, it's hard to see another path forward. But nine times out of ten, publishers should resist this urge.

Some elements of digital audience revenue programs can be esoteric (what to paywall, where to place barriers, etc.), but pricing feels like it should be calculable. After all, it's just numbers, right?

The reality is much more complicated. You can calculate based on audience size and revenue expectations, or on content production costs. Both are valid approaches. But exactly because European digital news markets are competitive, it makes sense to see what others are charging.

That's what our 2025 European Digital News Pricing Report is for.

We collected data from 101 publications across 19 countries (12 CEE, 7 “Western” European) to show you how publishers actually price their offerings.

We tracked:

Subscription tiers and prices

Annual and other types of discounts

Trials

Payment channels

We also included Netflix/Spotify pricing and economic indicators like median wages and GDP PPP to create a formula to help you make pricing decisions even if your country isn't in the sample.

We initially planned to release this report to paying subscribers only (just like our 2025 Newsletter playbook and our Audience research guide) given how much time and energy it took to compile. But thanks to Newspack’s generous sponsorship, it’s freely available to everyone.

Thinking about launching or improving your audience revenue program?

Newspack is an all-in-one publishing and monetization platform built specifically for digital newsrooms. It’s designed to streamline publishing, simplify tech operations, and support sustainable audience and revenue growth, right out of the box.

It’s developed and run by Automattic, the company behind WordPress, the infrastructure powering most of the open internet. Newspack was created to be a cost-effective tool for independent publishers and more than 300 for-profit and non-profit newsrooms across the globe have signed or launched on the platform.

Newspack comes with all the features necessary for quick and easy publishing, newsletter management, growing advertising and audience revenues. It helps outlets manage subscriptions, memberships, donations, content gating, first party data collection, and measure success with robust, easy-to-use analytics solutions.

We are proud to have partnered with Newspack to bring you this pricing report.

Check out Newspack here and book a free demo.

You can access the full report as a Notion mini-site here.

You can access the full report as a PDF here.

TLDR

💸 Average undiscounted monthly price at the lowest tier: €10.08

🏷️ Average undiscounted price at the lowest tier in CEE: €7.84

💥 Five reasons why starting cheap is risky

📰 Average number of tiers: 1.86

⚖️ The benefits and challenges of having a single tier of service

🔢 Annual discounts average: 22.15%

♟️ How to use strategic discounting to build a pipeline

❌ Free trials are out of vogue, discounted trials dominate

💳 Credit cards, bank transfers and the benefits of multiple payment channels

💰 The CSM pricing calculator will help you with a starting point even if your country is not listed this year

ℹ️10.08 euros is the average, undiscounted monthly price at the lowest tier

Let's start with some numbers*. The average undiscounted monthly price for the lowest tier subscription in our sample is €10.08. Unsurprisingly, there is a fairly big difference between Central and Eastern Europe and Western Europe in the sample. The CEE average price is €7.84 and the WE average price is €13.01. This mainly reflects the differences in salaries and disposable incomes.

* Methodology: All prices were converted to euros on June 23 at 15:00 CET, using the European Central Bank’s exchange rates at that time.

Five reasons why starting cheap is risky

1. 🌞Early adopters aren't very price-sensitive

When launching audience revenue, you'll convert fans and heavy users first. They're much less price-sensitive than casual readers. Even if you think most people would only pay €5, launch at €8 or €10. Convert as many as possible at higher prices in the first 6-12 months, then offer discounts as you mature and target casual readers and deal-seekers.

2. 🪄 Higher initial prices enable better discounting

You want annual subscribers, and discounts drive annual conversions. Starting at €8 lets you offer annual subscriptions at €80 instead of €96, still profitable. Start too low and your discount room disappears. Need student rates? Family packages? Institutional pricing? You need wiggle room.

3. ⚠️ Raising prices later is painful

Online payment systems and subscription structures make price increases complicated. Annual subscribers are locked in until renewal. Depending on the jurisdiction, increasing recurring payments requires notification (opt-out) or confirmation (opt-in), both creating friction and churn.

4. 🕰️ The conversion barrier is time and attention, not price

The biggest hurdle isn't the subscription cost, it's the mental effort of converting. Creating accounts, finding payment details, and completing checkout requires focused attention in a distraction-heavy world. If you value someone's time even at the median wage, the few minutes needed for signup often exceeds the price difference between a €6 and €8 monthly subscription.

Since capturing someone's undivided attention long enough to convert is your biggest challenge, optimize for that moment rather than shaving euros off the price. Once someone commits to the conversion process, a few extra euros per month rarely derails the decision.

5. 💬Journalism subscriptions aren't purely transactional

People pay for news for complex reasons involving emotional connection and belief in journalism's societal purpose. In purely transactional terms, competing with Netflix's infinite library would be impossible, yet many people pay more for journalism. Audiences will pay premiums for perceived community and societal value.

⁉️How many tiers? Optimize for conversion, then upsell

Publishers in our sample offered an average of 1.86 subscription tiers.

Single-tier pricing presents a revenue challenge: it excludes potential subscribers who can’t afford the set price, while missing out on additional income from those willing to pay more. In effect, you're likely losing money from both the most price-sensitive and the most affluent users.

Offering multiple tiers helps capture more value from each customer, but it comes at a cost. Complexity can hurt conversion. Too many choices make people stop and think, an opportunity to get distracted or change their minds.

A more effective strategy is to keep the initial decision simple, then upsell later through targeted communications such as email. Once someone is a paying customer, introduce premium tiers, supporter clubs, or family packages tailored to their engagement.

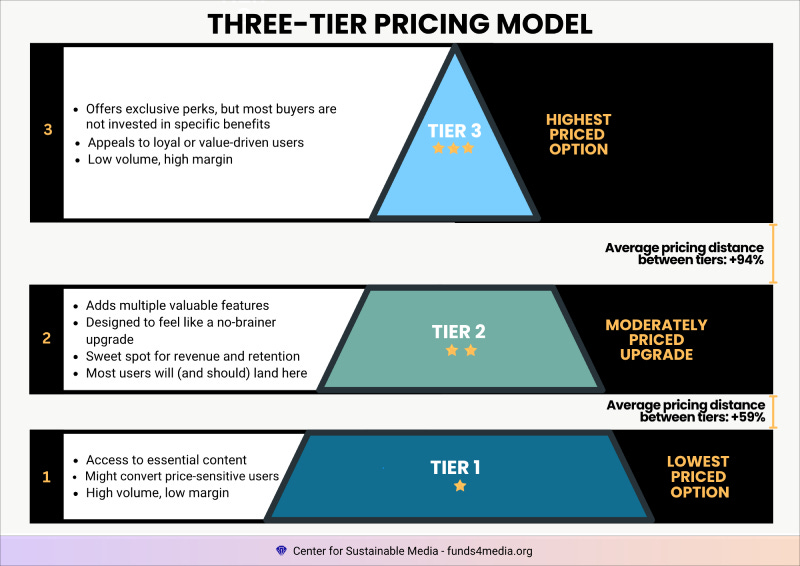

If you do offer multiple tiers, price strategically. In our analysis of programs with three service tiers, publishers used a modest jump between basic and middle tiers (€6.81 or 59% increase) but a massive leap to the premium tier (€10.93 or 94% increase):

⭐Tier 1: €11.56 (basic access)

⭐⭐Tier 2: €18.37 (enhanced features)

⭐⭐⭐Tier 3: €29.30 (premium/supporter level)

This structure works because higher tiers target your most enthusiastic supporters, readers who aren't price-sensitive and want to demonstrate their commitment to your journalism. The premium tier functions more like a donation with benefits than a pure subscription.

🤔Strategic discounting

The standard annual discount across digital services is 20%, essentially offering 12 months for the price of 10. Our sample aligns closely, with lowest-tier subscriptions averaging 22.15% annual discounts.

But discount rates shrink as tiers increase. Middle-tier annual discounts average just 16.59%, and premium tiers only 14.84%. This makes strategic sense: customers choosing higher-priced subscriptions are already demonstrating lower price sensitivity. Some publishers push this logic further, Manchester Mill actually charges more for their premium annual subscription than 12 monthly payments, treating it as a supporter donation rather than a discount-driven purchase.

Beyond annual discounts, publishers offer targeted reductions:

👥 35 offered multi-account discounts (corporate and family discounts)

👩🏫 21 offered student discounts

🎒 10 offered young reader rates (for some publishers the upper limit is 26, for others it's 35)

🧓Other categories include: retirees, unemployed, diaspora audiences, people with disabilities, parental leave

🤝Some used "solidarity pricing" where readers set their own rate

⏳Some opted for huge discounts for very long, 3 or even 5 year subscription cycles

Most publishers don't verify eligibility for these discounts, they operate on trust and see minimal abuse.

These programs also create upselling opportunities.

Several publishers run annual campaigns where paying subscribers are asked to fund discounted access for students or other groups, with the publisher often matching subscriber donations. This generates additional revenue while creating a pipeline, many subsidized users convert to full subscriptions once their discounted period ends, having developed consumption habits.

🎯The key insights:

Treat discounts as audience development tools, not just revenue optimization. Strategic discounting can expand your readership while maintaining premium pricing for your core supporters.

While offering multiple types of discounts may be appealing, as explained above, you want to keep the offer page, the main point of conversion relatively simple. Offering too many discounting options may become a distraction and a source of friction in the payment flow.

🕺Free trials are out of vogue, discounted trials dominate

Most publishers have moved away from offering free trials:

🆓 Only 10 publishers still provide free trials

🛍️ 53 offer discounted trials, averaging €2.02 for one month

🙅 38 offer no trial options at all

Trials become increasingly important as your audience revenue program matures. In the early stages, you’ll convert your most loyal readers, heavy users and superfans, at full price. But once that initial growth slows and churn begins to rise, discounted trials can help you reach more price-sensitive audiences and casual readers.

Offering discounted trials instead of completely free access is strategic. Even a small payment, just a couple of euros, creates a sense of value and commitment. Readers think, “I paid for this; I should make the most of it,” which often leads to increased usage and a higher likelihood of retention after the trial ends.

Habit formation takes time. Many successful publishers extend trial periods to three months or more, offering steep discounts. The rationale is simple: the longer the exposure, the more likely it is that consumption habits will stick, even after prices return to standard levels.

Timing is crucial. Launch without trials to maximize early revenue from your most engaged readers. Then, 12 to 18 months in, introduce discounted trials to attract new segments. This phased approach captures premium pricing upfront while laying the groundwork for broader audience conversion as your program scales.

Think of discounted trials not as short-term revenue tools, but as long-term investments in audience development. You’re buying time to turn casual visitors into committed subscribers.

📱Payment channels: remove friction

Even perfect pricing won't work if people can't easily pay. All publishers in our sample accepted card payments, but smart newsrooms go much further to reduce payment friction.

Bank transfers remain surprisingly popular, almost half of publishers in the sample offer this option. While it seems old-fashioned, bank transfers appeal to readers who prefer direct debits or have concerns about storing card details online.

Other popular payment channels were:

Paypal - 46 publishers

Google Pay - 34 publishers

Apple Pay - 20 publishers

Stripe/Link - 14 publishers

Regional payment preferences persist. Many publishers integrate local processors because audiences trust familiar, nationally-recognized payment brands. In Central and Eastern Europe, 9 publishers still offer SMS-based payments, and 5 allow premium-rate phone subscriptions, reflecting both local payment habits and audiences who prefer not to use cards online.

Even niche payment methods find their audience. Only 4 publishers accept cryptocurrency payments, targeting privacy-conscious readers who prioritize transaction anonymity.

Partnering with Newspack allowed us to make this report freely available to everyone. We hope the data and insights help your newsroom make the best decisions about pricing, discounting, tier design, and more.

Newspack was a natural fit for this project. Built specifically for independent digital newsrooms, it’s a cost-effective, all-in-one platform that covers everything from publishing and newsletters to analytics, subscriptions, memberships, donations, ad revenue, and more.

Developed by Automattict, the company behind WordPress, Newspack is part of the world’s most widely used open publishing ecosystem. It’s quick to deploy, easy to use, and designed to support sustainable growth for publishers like yours.

👉 Learn more and book a free demo

🧮 Price calculator

We’ve created a pricing calculator to provide a starting point, even if your country isn't included in this year's list.

You’ll need four data points:

The lowest available Spotify subscription in your country

The lowest available Netflix subscription in your country

Your country’s annual GDP (PPP), you can find the latest figures on the World Bank’s website.

The average monthly earnings in your country (we used Eurostat figures for our sample)

Once you have these numbers, enter them into our calculator here.

It will estimate the undiscounted monthly price of your basic tier. For the 19 countries in our sample, the calculator predicted country prices with an average margin of error of just 0.26 cents.

Methodology

📍 Sample

This report examines the audience revenue programs, pricing and discount strategies, and offer structures of 101 news organizations across Europe.

Our sample includes organizations from 12 countries in Central and Eastern Europe:

Bulgaria

Croatia

Czech Republic

Estonia

Hungary

Latvia

Lithuania

Poland

Romania

Serbia

Slovakia

Slovenia

And from 7 countries in Western, Northern, and Southern Europe:

Austria

France

Germany

Italy

Norway

Spain

United Kingdom

We aimed to include a diverse range of actors in each market. However, some Central and Eastern European (CEE) countries, such as Serbia and Bulgaria, have a limited number of outlets offering membership or subscription programs. Our analysis focuses only on newsrooms producing content in the local language for local or national audiences.

Because of these limitations, we believe the dataset offers insights with both regional (CEE vs. Western Europe) and pan-European relevance, though it may not be fully representative of each individual country.

💵 Pricing

We aimed to capture undiscounted prices across all outlets in our sample. We consider this the most useful reference point for publishers developing audience revenue strategies and refining their pricing models.

🧱 Tiers of Service

We recorded information on service tiers when it was clearly presented on the subscription landing pages. If multiple digital tiers were offered, we noted those. We also treated "Digital" and "Digital + Print" bundles as distinct tiers, provided they were marketed together at a unique price.

You can find a more detailed description of our methodology here.

If you want to access the raw dataset, drop us an email on hello@funds4media.org